But "offer in compromise mills" can aggressively promote offers in compromise in misleading ways to people who clearly don't meet the qualifications, often costing taxpayers thousands of dollars.

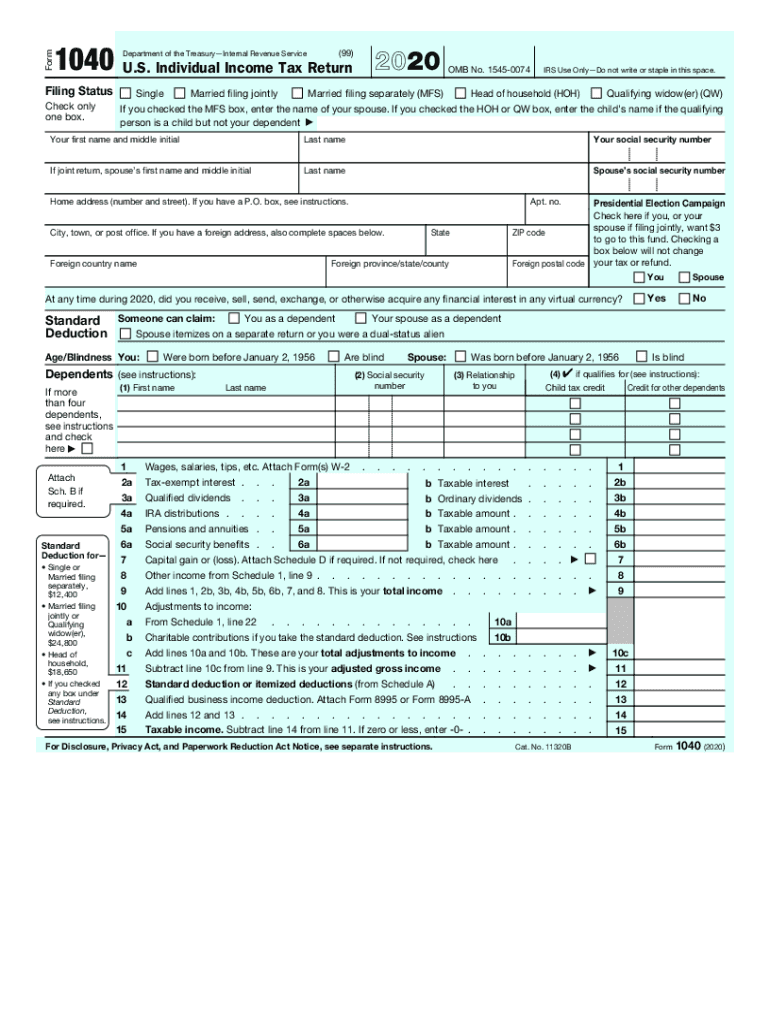

Offers in compromise are an important program to help people who can't pay to settle their federal tax debts. The IRS will make the final decision on whether to accept the taxpayer's application. Taxpayers can enter their financial information and tax filing status in the tool to calculate a preliminary offer amount. Taxpayers can see if they're eligible with the pre-qualifier tool

0 kommentar(er)

0 kommentar(er)